有关Mutual Fund投资

user3097-3097 03/17 71545.0/1

1。Why MF

•股市投资风险

–市场风险: 公司运营,经济,突发事件, etc.

•降低市场风险: diversification across different asset categories, sectors, etc

–管理风险: what, when, how much to buy/sell? 可以部分控制。

•降低管理风险: professional service

因素: 时间+费用+知识+灵活性

个人:花大量时间,高知识,高灵活性

专家:个性化专家服务,高费用/门槛,业绩不易比较评估

MF = 个人+专家结合:花少量费用,少量时间,获有限专家服务, 解决理财难题

MF的Pros and cons

•优点:

–专家管理, 选择广泛,

–有限风险: 避免单股下跌血本无归

–透明度高:费用公开,投资目标固定,持股公开

–分析工具多: 随时比较,监控,不合适可马上换

•缺点:

–不能指望发大财, 基本跟大盘走

–有费用,每年可能因dividend和capital gains distribution而交税,即使当年亏本

–不可intra day trade

–种类繁多,不易选择

2。MF的分类

•Domestic Stock:

–Large Cap: blend, value, growth

–Mid Cap: blend, value, growth

–Small Cap: blend, value, growth

•Fixed Income (bonds): corporate, treasury, high-yield, etc

•Short-term: MMkt Funds

•Hybrid (mixed asset): fund of fund, age-targeted

•Selector Funds: real estate, tech, bio, health, utilities, etc

•International

Tips: There are other classification methods. This is not a complete list.

MF Features

•Returns and rankings: comparing within category

•Expenses: management fee, 12b-1 fee, load, etc

•Turnover rate: how often manages sells; affecting CG distribution

•Manager tenure: how long same manger has been in position

•Fund Asset: size of the fund – smaller better

•Volatility: math models measuring risks

•Morningstar Rating: overall up to 5 star (more to come)

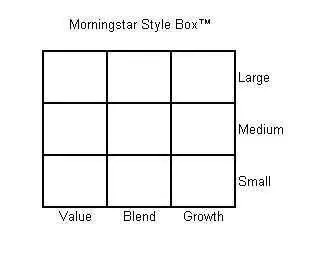

Capital Sizes in MF Holdings

•Large Cap: 10B+

•Mid Cap: 2B – 10B

•Small Cap: under 2B

Style Classification

Style: math model based on price/earning ratio (P/E) and price/book ratio (P/B)

•Growth: greater long-term capital appreciation potentials

•Value: currently priced under value – low P/E,P/B

•Blend: stabilized

Tips: growth bears highest risk, value next, blend lowest

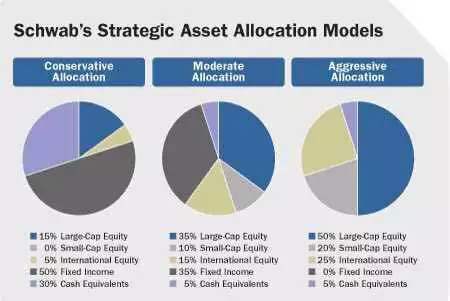

3。投资组合

投资组合Asset Allocation

•Long tem speaking, asset allocation is more important than single fund selection

•There is no one-fit-all model

•How to allocate: depend on your age, time horizon, personality, risk-tolerance

•Different experts give different answers

•Here is one answer

Tips: stick to your asset allocation

4。MF的费用

•Gross Expense ratio – required to disclose

– Management fee

–Administrative fee

–Advertising fee (12b-1)

•Net Expense Ratio – not required to disclose

–Gross Expense minutes fee waivers and reimbursements

Tip 1: don’t buy a fund that makes a lot of ads: your are paying for it

Tip 2: Returns are not predictable but expenses are

Max allowed exp ratio is 8.5 % by law.

MF load

•Front-end load (load):

–Commission paid to sales (brokers or financial advisors)

•Backend-load (deferred load);

–Charges if you sell share within certain period of time after purchase

Tips: load is usually waived when purchasing directly online with MF company or within 401K plans or LI products.

MF Share Classes

Some fund companies make same MF into different classes based on fees structures, mainly to encourage long-term investment

•A Shares: front-end charge, lowest exp

•B Shares: backend charge if sell within certain years (4 to 8 years), charge decrease over years, mid exp, converting to A shares after charge period

•C Shares: backend charge if sell within a short period of time (a year), high exp, can’t convert

•Other Shares: I (institutional), D shares, R5, etc

Tips: buy no load funds

Popular companies like Fidelity, Vanguard have got rid of funds with load completely.

MF load and expenses example (1)

•Legg Mason Opportunity Trust Class A LMCJX

Gross exp ratio 1.56%, Net exp ratio 1.56%, load 5.75%, min invest $2,500.00

•Legg Mason Opportunity Trust Class I LMNOX: Gross exp ratio 1.28%, Net exp ratio 1.28%, $1,000,000.00

You can tell exp difference. For long run it makes a huge deal.

MF load and expenses example (2)

•BCCHX - BlackRock Emerging Markets Dividend Fund Investor C Shares: Gross exp ratio 8.38%, Net exp ratio 2.51%, Deferred load 1.0%, min invest $2,500.00

•BACHX - BlackRock Emerging Markets Dividend Fund Investor A Shares: Gross exp ratio 7.44%, Net exp 1.76%, load 5.25%, min invest $2,500.00

•BICHX -BlackRock Emerging Markets Dividend Fund Institutional Shares: Gross exp ratio 6.99%, Net exp ratio 1.51%, min invest $2,000,000.00

Tips: look for I shares in your 401K

Exact same fund, different tickers due to different fee structure.

MF load and expenses example (3)

•Vanguard 500 Index Fund Investor Shares (VFINX): exp ratio: 0.17%, min $3,000

•Vanguard 500 Index Fund Admiral Shares (VFIAX): exp: 0.05%, min $10,000

•Spartan® 500 Index Fund - Investor Class FUSEX: Gross exp ratio: 0.1%, Net exp ratio: 0.095%, min $2,500

•Spartan® 500 Index Fund - Fidelity Advantage Class FUSVX: Gross exp ratio : 0.07%, Net exp ratio : 0.05%, min $10,000

•Dreyfus S&P 500 Index Fund PEOPX: Gross exp ratio: 0.51%, Gross exp ratio: 0.5%, min: $2500

Tips: pick index funds with lowest exp ratio

If you want to buy index fund, nobody beats Vanguard. Fidelity is close.

5。如何选择MF

•Pick a category first: compare within same category

•Morningstar rating: 4+ stars (more to come)

•Find a tool and compare for same star funds. Consider these factors:

–Returns: look for multiple years, not only 1 year or YTD

–Exp ratio: Returns are not predictable but fees are; small/mid caps are more expensive than large cap; index lowest; In 401k, select Institutional classes (given similar returns) as you can not get it from outside investment

–Turnover Rate: affecting CG distribution, < 25%; smaller cap is higher; not affecting IRA

–Manager Tenure: avoid new managers

–Asset size: if too big will become in expensive index fund

For long term in regular accounts, I would go with low turnover rate funds. Leave those high turnover rate funds in you IRA accounts to minimize tax on CG distribution.

Morningstar Rating for Funds

1 – 5 Stars based on performance, after adjusting for risk and accounting for sales charges, in comparison to similar funds.

•5 stars : top 10% in category

•4 stars: next 22.5% in category

•3 stars: next 35% in category

•2 star: next 22.5% in category

•1 star: bottom 10% in category

Tip 1: Aim at long term. Don’t chase high performers. History does not guarantee future performance.

Tip 2: Give a fund some time to perform. Check in months, not days

This is the most popular used measure for MF research. It is not only about returns but also includes risks. And it compares within each category, i.e., Apple to Apple.

Morningstar rates YTD, one year, three year, give year, overall. Not sure exactly how often but should be pretty current, as if last month end or so.

How and When to buy/Sell

•Target for long term investment

•No market timing

•Invest monthly: dollar average to avoid timing market

•If large amount, put in monthly, not at once

•Stick to it for at least a year

•Sell only when performance is consistently poor

•Check Morningstar ratings periodically

6。MF资源与分析

MF资源与分析

•Fidelity.com

•Vanguard.com

•Morningstar.com

•yahoo finance

You can get real time quotes from fidelity if you login.

Final MF Tips

•Do not choose too many funds in any of your portfolios; otherwise a portfolio will become an expansive index and can’t beat index funds due to higher costs.

•It is not the more the better.

•Try to a manageable number of funds, ideally under 10.

7。Q&A

Q:Why smaller asset size?

A:Small company stocks, greater growth potential. Smaller sized funds are easier to manage, especially for small cap funds. Small cap funds tend to close quickly when sizes reach certain level to protect existing investors.

Q:P/b ratio( Price to book per share)是大好還是小好?

A:小好,大代表over valued.

Q:如果是401k里的i share就沒有minimum investment限制了吧?

A:對,也沒有有load.Take advantage of these I shares in you 401K.

Q: How do you decide what to buy:

A: already covered: find a category, screen for a fund: rating, returns, expenses,turnover rate, manager tenure, asset size

Q: For the same type (let's say mid cap growth), there are also so many similar funds. How do you decide which one to buy?

A: see above answer

Q: After you decide what to buy, when to buy?

A: I believe long term. No market timing. I usually do monthly automatic investment to minimize market timing impact. If you have a lump sum to put in, spread it out over 6 months or so.

Q: What will prompt you to sell?

A: Review performance periodically (yearly, not too often). If consistently 4+ star rating, don’t touch. If 3 star or lower, look at same category to see if all behave the same. If same (sometimes entire sector/asset class are bad), don’t touch. If not, switch to another fund on same day to avoid market timing risk. Considering capital gain impact, better sell before CG distribution date (early December for annual distribution. Some distribute semi-annually or quarterly. Check fund website for dates). IRA accounts can be managed more actively than regular accounts due to tax efficiency.

Q: 有哪些有load的MF值得考虑?

A: There are many good funds with no load and low expenses. So I would not consider a fund with load, unless its load is waived (e.g., inside 401K, waived online). If this case, evaluate other factors as usual.

Q: 现在的ETF有望代替mutual fund 吗?

A: I don’t believe so in near future. They serve different purposes. In terms of diversification and professional management, MF is better.

Q: 如何选fund, 即在买MF 时哪些因素需考虑(如类别,回报率,费用...)?

A: Already covered. See previous answers.

Q: 在市场高位时,如卖出MF,除MM和bond 外还有哪些类fund 可作为“避风港”?

A: Avoid timing market. If really want to sell, try conservative funds, such as large cap.

Q: Load, non load 哪一个好,为什么?

A: Already covered: no load is better.

Q: Lazy person,入账MF后基本不动, 哪些指标要注意?

A: Check annually, rebalance, record year-to-date returns, stick to your asset allocation. Pick new ones following same criteria: rating, returns, etc. If want to sell and buy, do exchange to avoid market timing.

Q: 什么原因会让你换掉基金。另外你是否研究选择基金经理。怎样选。

A: Already covered: category, rating, expenses, turnover rate (does not matter in retirement accounts), manager tenure, asset size. Long term investment strategy, discourage frequent switching or timing market.

Q: 怎么去选bond funds?

A: Same criteria as mentioned before. But pay attention to dividend distributions. I use these more in tax-deferred accounts (401K, IRA).

Q: 我有个关于international MF的问题,是买total international stock market MF,还是slice and dice 分别选择Developed and emerging market,另外就是international equity 的allocation问题,到底该在equity占多大比重?

A: Already covered in pie chart slides. 5%-10% maximal for me. Avoid “World” funds as they contains US equity and hard to compare. Let international be strictly non-US equity for clearer comparison and allocation. I choose general international funds, not so regional. Personal choices.

Q:why MF is better than ETF?

A:lower risk

Q:Why MF has lower risk than ETF, both are a mixture of stocks?

A:In general. Some ETF has 3X loss or gain. MF is strictly regulated.

Q:决定mf价格的因素都有哪些呢?在这方面和股票有什么相似和不同么?

A:MF follows broader market. Volatility is lower than individual stocks. But since MF consists of stocks, they follow same fundamentals. But MF does not go up when more people buy same fund. It just creates more shares. Stocks are different in this sense.

Q:so open ended funds price is only affected by underlying secures?Not supply and demand?

A:Yes.Don't buy a fund because if is lower priced.

Q:But close ended funds are different in pricing mechanism, right?

A:correct. These funds shares are fixed.

声明(Disclaimer):

•文中所谈纯属分享个人知识与经验,只供参考,不具投资指导效力。

•文中提到的任何基金只作例子,不表示推荐。

•文中仅涉及open-end的基金。

•文中以股票基金为主。

•Giving this talk by no means implies I am an investment expert or successful mutual fund investor

感谢万江铃的讲解和分享!