ÕŁ”Õī║µĆ╗ńøæDr Max McGee õĖÄÕŹÄõ║║ńżŠÕī║Õ«ČķĢ┐Ķ░łMeasure A õ╝ÜĶ««Ķ«░ÕĮĢ

Jackie-2668 04/21 7999

Measure A Ķ««µĪłńÜäĶāīµÖ»ÕÆīńö©Õżä

Meeting Summary

Monday evening 4/20

Superintendent Dr. Max McGee and PAUSD

School board president Melissa Baten Caswell

School board former candidates: Gina, and Catherine;

Chinese community leaders Lydia Kou and Debra’╝īVictoria

Thanks to Lydia to organize this important event. About 25 attended the meeting.

Dr. McGee has excellent experience and credential. He was the Superintendent for the entire Illinoi state, supervising all districts Superintendents in the state.

Meeting summary:

School officials met with Chinese parents in our community, discussed Measure A and answered questions from our community.

http://supportpaloaltoschools.nationbuilder.com/

Here are my notes:

1. What is the cost of Measure A’╝¤What was the old parcel tax used for? What is the new parcel tax intended use?

a. Measure A will increase each familyŌĆÖs parcel tax $128 per year above the current parcel tax each parcel is paying. The total parcel each family will pay if adopted is about $750 a year.

b. Last parcel tax was put in place in 2010 and expected expiring in a year at 2016

The parcel tax was not intended to substitute regular school expenditure, but mainly to reduce class size from 30 plus to less than 25. More teachers need to be hired for smaller classroom.

c. Why new parcel tax

i. Existing parcel tax expiring, need new tax to replace the missing fund

ii. PAUSD has increased student enrollment by 1100 since then

iii. The new parcel tax is total of 13 Million dollars. The intended major use is two fold:

iiii. Maintain small class room size

v. Providing counseling and psychological service, hiring school nurse for K-5 and keep school library open and stuffed

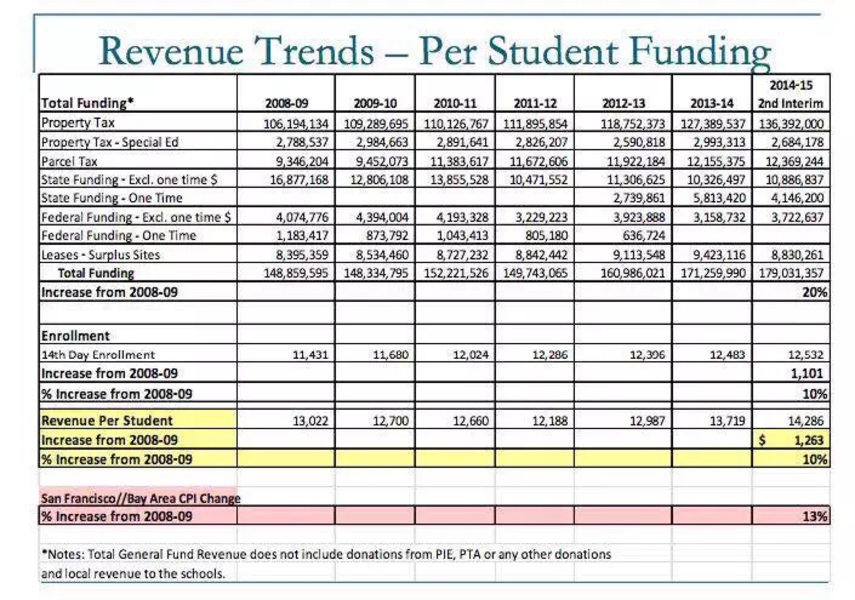

2. What are the numbers? What is the bottom line number putting together?

The spread sheet is prepared by district office, and presented to the recent school board meeting, which opens to public.

a. How much tax revenue increase from last vote?

Per student tax increase is 10% from the time of last vote

b. How much cost increase per student?

The accumulated inflation induced cost increase per student is 13% since the voting of the last measure

c. How many student increases in the district?

i. 1100 more student since last vote

ii. Expected 700 + more student in the next voting period, could be more

The total cost per student, due to inflation and increased student enrollment, will be short of 13 million to maintain small classroom size, and provide needed counseling service.

3. Palo AltoŌĆÖs school budget is higher than Cupertino and Fremont, where does the money go? What is the difference?

Palo Alto teacher gets highest pay in the area? The major difference of Palo Alto and Cupertino school district is classroom size.

o Cupertino is typically 35 students per classroom;

o Palo Alto is typical 20 to less than 25.

Ō¢¬ Most Palo Alto parents feels that it is critical to have smaller classroom size, and kids can get more of teacherŌĆÖs attention

o Palo Alto teacherŌĆÖs pay is ranked 5th in bay area.

Ō¢¬ A top teacher could get $10K more in Los AltoŌĆÖs district. An excellent teacher quit and joined Menlo Park district for more pay two years ago.

Ō¢¬ Palo Alto needs to keep teacherŌĆÖs salary competitive to safe guard good teachers.

Ō¢¬ Small classroom size is critical to retain good teachers, in addition to benefit to students. Many teachers voiced that smaller classroom size make them enjoy teaching more. This is a critical retention tool for good teacher

4. Palo Alto school districtŌĆÖs per student spending is one of the highest in the country, why the performance is not very good. Why the performance of many teachers so poor? What can we do about it? Can they be fired?

a. Dr. McGee shared per student spending

i. Palo Alto school district spend $14K per student

ii. Comparable school ŌĆ£Illinoi School of Science and TechnologyŌĆØ spend $20k per student

iii. State of New Jersey spend $21K per year per student, State of New York spend $21K per student (http://www.nea.org/assets/docs/NEA_Rankings_And_Estimates-2015-03-11a.pdf, page 85)

iiii. Palo AltoŌĆÖs per student budget is tight, compare to nations comparable schools

b. TeacherŌĆÖs poor performance is an important and critical issue to be addressed

i. Dr. McGee will have regular dialogue with students and parents

ii. Will institute an anonymous student survey to provide feed back to students, teachers, parents and administration

iii. Hiring bad teacher is the principalŌĆÖs fault. Principal can be fired if doing a poor hiring job

iiii. School does not have right to fire tenured teacher. Union law protects teachers. This is beyond principal or superintendentŌĆÖs power. However, school district can find ways to punish those who are not responsible.

Parents inputs: Many parents felt their concerns were ignored. Regular communication meeting is important. Parents feed back mechanism establishment is important

It is recommended that districts looking for parcel tax renewals, go out for a renewal before the existing tax expires to reduce the risk of a gap in funding and then subsequent teacher layoffs if it does not pass.Running a campaign is expensive. Hundreds of volunteers, thousands of volunteer hours. $ costs of approx. $300K. If the parcel tax renewal does not pass this time, it will be hard to get folks to give time and money again to run another campaign so soon after this first one.Palo Alto school budgets, even WITH Measure A, are only funded at the average for the US. Yet our community expects Palo Alto to deliver programs and results comparable to the best funded school districts in the nation; excellent academics, prize winning students, small class sizes, robust student supports, bountiful enrichment opportunities, mental health services, innovative teaching practices, etc. Voting no will not send a message or fix problems it just will result in more challenges locally.

In summary:

Measure A is aimed to reduce classroom size, and provide additional psychological counseling for student community.

The fund needed for it is not covered by regular school budget.

$13 Million is needed which translate into $128 additional per family per year. This additional increase is due to increased enrollment and accumulated inflation in the past years that out grow of tax revenue increase. (Property tax is not based on property market value, but sold value)

This measure needs 2/3 votes to pass.

Your support is critical to pass this important measure for Palo Alto Children

Ķ░óĶ░óµö»µīüÕÆīÕģ│µ│©/:@)